Donald Trump at the Menie Estate, on the Aberdeenshire coast of Scotland, May 27, 2010.AP/Andrew Milligan/PA Wire

When ordinary Republicans are informed how President Donald Trump’s flagship “One Big Beautiful Bill” that their leaders are currently debating in the Senate—a package of tax and spending cuts that, in current form, would slash spending on Medicaid and food stamps while adding an estimated $2.8 trillion to the deficit—would affect the after-tax incomes of American families, it turns out they don’t find it beautiful at all.

That’s one takeaway from a new survey of about 4,500 US respondents by Yale political science professor Jacob Hacker and his post-doctoral researcher Patrick Sullivan at the American Political Economy eXchange, an initiative Hacker directs within Yale’s Institution for Social and Policy Studies. But the magnitude of their findings was truly surprising to Sullivan, whose past work also has involved the ways people’s attitudes and preferences change in response to new information.

“I was really shocked. I do a lot of survey experiments and to see effects that big is quite something.”

As Sullivan notes below, this Treasury-busting megabill—which Republicans aim to pass without Democratic input, side-stepping the filibuster threat via a rules process known as “reconciliation”—has been polling poorly. “As unpopular as the bill is,” Hacker and Sullivan wrote in a New York Times op-ed on Wednesday, “Americans have yet to fully understand the special alchemy of inegalitarianism that defines it.”

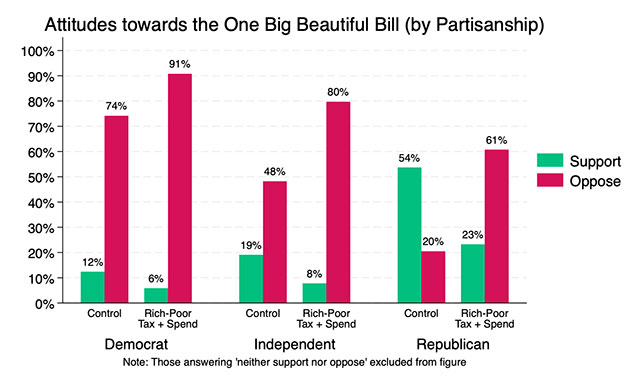

The most support and least opposition, of course, comes from Republican voters. But apparently even Trump’s die-hard fans are appalled when they are shown how the bill’s provisions will affect the finances of the nation’s richest and poorest households—not that they’d ever hear it on Fox News.

So, Patrick, tell us about the basic setup.

We ran a survey to examine how giving people information on the distributional effects of the One Big Beautiful Bill effects attitudes towards it. We asked one group—the control group—directly about their support or opposition.

Another subset received information on the tax implications—using [Yale’s] Budget Lab data, we showed them how much after-tax incomes would change amongst those in the top 1 percent (an increase of about 4 percent), and for the poorest households—the bottom quintile—who would only see after-tax incomes increase by about 0.5 percent.

A third group received information on the ramifications of the changes to both taxes and spending for those in the top 1 percent and the bottom quintile: The top 1 percent gets its 4 percent increase still, but in the bottom quintile, household incomes decrease on average by 3.8 percent.

The results for the control condition were in line with other recent public polling, like Kaiser Family Foundation and Quinnipiac polls: Overall support for the bill was 28 percent and opposition was 47 percent. So it’s already unpopular.

When we showed respondents information on the tax end, support went down a bit, from 28 percent to 24, but opposition increased by nearly 20 percentage points, from 47 percent to 65 percent.

Whoa! So you must have had a bunch of undecided respondents in your control group who neither approved nor disapproved?

Yeah. And we saw the biggest movement [away from the control results] when we showed people our second treatment—on the tax and spending.

At least on the tax end you can make the argument that, okay, everybody’s a little bit better off. It’s unfair, but at least nobody’s getting completely screwed over—although it’s still certainly regressive. But when they see this loss component [from the spending cuts], that seemed to really move people relative to the control group.

In the taxing and spending condition, overall support drops to 11 percent, so already-tepid support drops by over half. And opposition goes from 47 percent to 78 percent, up 31 percentage points, a 66 percent increase! And then we have an opposed/support ratio of basically 7 to 1.

I was really shocked. I do a lot of survey experiments and to see effects that big is quite something.

And this wasn’t just a bunch of liberals. How did results differ by party?

Yeah, partisanship is a big thing, especially when Republicans leaders are trying to portray themselves as the working-class party. For Democrats, baseline support was like 12 percent and when we [highlight both tax and spending effects], it goes to like 6 percent. Amongst independents, in our [tax and spending] condition, opposition outnumbered support I think 10 to 1.

But the really interesting thing was the Republicans. In our baseline condition, Republican support was around 54 percent and opposition was only 20 percent. When we show them just the tax end, it becomes about equal—47 percent support to 44 percent opposition.

But when we show the taxing and spending side, support drops to 23 percent and opposition goes to 61 percent—a three-fold increase in opposition relative to the control—and support drops by over half. The nearly 3-to-1 ratio of support to opposition from the control condition is flipped.

So people who understand the distributional effects see this bill very differently.

Yeah. The top-line numbers, I think, piss people off quite a bit. I mean, to get to this point where you’re at 11 percent overall support and 78 percent opposition. And you have Republican opposition dominating support in that second group—that was really eye-popping for me.

What does this tell you about the quality of information people are consuming?

We focused on this a little more in our Equitable Growth policy brief. We suspect Republicans have been focusing on these putatively populist provisions like no taxes on tips, no taxes on overtime—those are easy to digest. But there are so few folks working in tipped occupations and collecting overtime, and a lot of tipped workers wouldn’t even benefit from these provisions. It’s not going to make a huge difference for [most] less-affluent households. Whereas [people are less likely to know about] the pass-through business deduction Republican lawmakers want to expand, which is one of the worst tax provisions ever to seriously be considered.

And people have a tough time understanding marginal tax rates—some of my research has been on that, where people think your marginal rate is your average rate. And understanding deductions and how they interact with stuff is really complicated. Most people don’t have these sources of income, so why would they pay attention to something like the pass-through business deduction or the estate tax?

We ran another survey recently that asked—we gave them some options—how high do you think the estate tax exemption threshold is? Our correct answer was over $10 million at the time. Only about 8 percent of folks clicked that answer. It really comes as an informational shock. It’s kind of an out-of-sight, out-of-mind kind of thing. But Medicaid cuts and SNAP cuts are somewhat familiar.

The other thing too, is, Republicans [try to say] we’re not actually cutting these things. We’re just trying to make sure the system doesn’t get taken advantage of. A lot of people who agree with that kind of sentiment don’t realize that the end result will be bigger administrative burdens that are going to prevent a lot of people who are eligible from gaining access to these benefits.

Bury ‘em in paperwork! So much for Republican opposition to bureaucracy.

Yeah. The second thing we talked about in [the brief] was how the hidden, regressive tax cuts, in terms of cost and the upward redistribution, totally outpace these putatively populous tax provisions—and then, obviously, the spending cuts. Jacob [Hacker], one of his big things was how states are in a fiscally bad situation right now, and if we cut Medicaid and SNAP, that’s going to put a lot more fiscal strain on them. And this could become somewhat of a vicious cycle.

The basic idea of work requirements sounds pretty reasonable: People will say, sure, why shouldn’t these people work? But I think most don’t realize that most Medicaid beneficiaries already work, at least the ones who are able.

Exactly. There’s a lot of misperceptions around that. I think the CBO estimates show that these work requirements aren’t really going to do anything to increase employment, either. The Republicans can claim they’re not cutting anything, but these big roadblocks will have that effect. These barriers are going to prevent people from applying for benefits, or folks are going to get denied who would otherwise have had access.

This bill will leave the whole bottom 40 percent of Americans with less income after taxes and benefits. Which is striking to me because, as I learned while writing my book, the average family in that group has zero wealth. So maybe it’s not so beautiful?

Yeah. I find it super striking, too, in the context of the boomers getting older: A lot of people are calling this one of the greatest transfers of private wealth, generationally, in history. And yet, you have these bottom 40 percent who are going to lose out on that. This [bill affects] income, but that obviously has an impact on wealth.

On the flipside, it will increase the estate tax exemption threshold—which is already insanely high [$14 million; $28 million for couples]—by $1 million for individuals, and double that for couples. It’s kind of grotesque and really cruel. I mean, to spend vast sums of money in a way that the benefits overwhelmingly flow to the affluent and are partially financed by draconian spending cuts?

The cuts that will gut programs for really vulnerable folks, or less affluent Americans, are the sickest part. Jacob and I, when we kept reading into it, there was something new every day you find that makes this thing feel worse and worse.

The Senate parliamentarian has challenged several of the bill’s big provisions, ruling they can’t be done under the rules of reconciliation. Now some Republican leaders are calling for her head.

You do have two wings in the Senate right now. The ostensibly more moderate Republicans like Josh Hawley (R-Mo.) have come out a little bit against the Medicaid cuts. And there are deficit hawks, in quotation marks, like Rand Paul (R-Ky.). But then you have somebody like Ron Johnson (R-Wis.), who seems totally okay with the tax breaks, but he’s still harping about the deficit. We’ve got to cut more! God forbid we get rid of the tax cuts.

This interview has been edited for length and clarity.